Mortgage rates forecast for October 2018

Mortgage rate trends are inherently unpredictable — right up there with economic recessions and stock prices.

But even non-experts could do a pretty good job guessing where mortgage rates will go for the rest of the year.

With a hot economy, an active Federal Reserve, and inflation starting to tick up, mortgage rates would have a really hard time going down.

The best we can hope for is that they stay where they are long enough for homebuyers and refinance candidates to lock in.

Luckily, 30-year fixed rates are still in the 4s. This was considered an impossible range just a few years ago. Despite incessant rate increases, these rates are somehow still available.

Don’t want a rate over 5%? Now could be the time to act.

Apply today for a Mortgage and lock in today's low ratePredictions for October and the rest of 2018

There is no shortage of market-moving news in October. Developments now will impact your ability to buy or refinance this month and in the remainder of the year.

Rates forecast at the beginning of the year has pretty much come true. Most major housing and financial authorities predicted rates somewhere between 4.7% and 5.0% for 2018.

According to Freddie Mac, the average 30-year fixed rate for an ideal candidate jumped to 4.72% at the end of September. That’s very close to the rough 4.75% rate you get when you average predictions from seven agencies like Realtor.com and the National Association of Home Builders.

The good news is that we are not very likely to see any more huge jumps for the remainder of the year if forecasts are accurate.

But, we are very likely to see a gradual increase until January 2019, starting the year in the high 4s.

Been looking for a good rate on a refinance or home purchase? Now might be the time to lock.

Start the home buying or refinance lock-in process here. (Oct 3rd, 2018)

The economy appears unstoppable, and that’s bad for rates

A hot economy is an enemy to low rates, and there’s little doubt we’re in a hot economy.

The unemployment rate is at 3.9%, considered very low. There is now less than one unemployed worker for every available job. Yep, there are now more jobs than workers to fill them.

Compare that with 2009, when there were more than 6 unemployed workers for every available job.

It’s a “workers market,” and that’s good for people in general, because — just taking a wild guess here — most of us would rather have income than an ultra-low mortgage rate.

But it’s not so good for those looking to buy or refinance.

Inflation is bad for mortgage rates. The simple equation emerges: hot economy = inflation = higher mortgage rates

This worker shortage will eventually lead to inflation as companies pay more to hire and retain workers. These firms then pass on those costs via higher priced products.

Higher prices for goods and services is the very definition of inflation.

Inflation is bad for mortgage rates. The simple equation emerges:

Hot economy = inflation = higher mortgage rates

So what’s a home mortgage shopper to do? Simply lock in as soon as you can. We won’t be getting off this economic tour de force for a while.

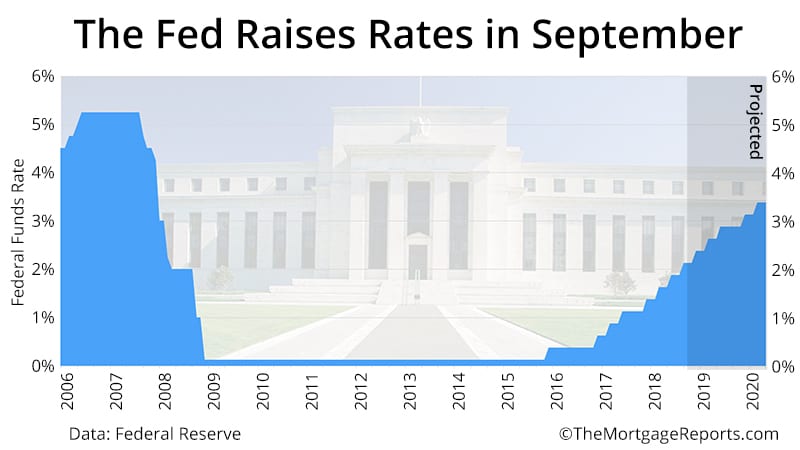

The Fed just hiked rates, and will again in December

The most recent meeting of the Federal Open Market Committee (aka “The Fed”) just ended September 26. As everyone expected, the group hiked its benchmark federal funds rate.

While the action didn’t directly affect mortgage rates, it did lend to an overall environment of rising rates, which certainly doesn’t help the mortgage rate shopper.

And, expect another rate hike in December. Twelve of the 16 Fed meeting participants predict one more hike in 2018. That would make a total of four rate increases this year.

Those who are waiting for rates to go down may be sadly disappointed in 2018.

However, for those who are willing to wait a bit, many experts are predicting a recession in 2020. Half the economists surveyed in a recent poll by the National Association of Business Economics indicate an oncoming recession.

An economic pull-back could prompt the Fed to lower the fed funds rate. The Fed could even make mortgage rates artificially low like it did in the wake of the 2008 crisis.

(Many economists believe that the Fed is hiking rates now partially because it needs to cut them if the economy turns south.)

For homeowners who just want to refinance, a 2020 rate drop might be worth waiting for. But for a homebuyer, it could backfire. Home prices could be 10 to 20 percent higher by then, negating any rate savings.

Think you’ll be buying in the next couple of years? Today’s rates may be the best we see.

Verify your new rate (Oct 3rd, 2018)

Mortgage rate trends for the rest of 2018 and 2019

Mortgage rates have already surpassed predictions cast by major housing agencies. Now, the question is, what are these groups forecasting for the remainder of the year?

| Agency | 2018 Prediction | 2019 Prediction |

| Mortgage Bankers Association | 4.7% | 5.2% |

| Freddie Mac | 4.5% | 5.1% |

| Fannie Mae | 4.6% | 4.7% |

| Realtor.com | 5.0% | No forecast |

| National Association of Realtors | 4.6% | 5.0% |

| Kiplinger | 4.8% | No forecast |

| National Association of Home Builders | 4.53% | 4.88% |

To sum it up, everyone is predicting higher rates. Today’s rate might be as good as we’ll see for years to come.

Verify your new rate (Oct 3rd, 2018)

Advice for October 2018

Knowing what will happen in October is only half the battle. As a mortgage rate shopper, now you need to know the best actions to take this month.

Don’t automatically dismiss a cash-out refinance

Homeowners have racked up a monumental amount of home equity in recent years. According to statistics site Statista, U.S. homeowners are sitting on more than $14 trillion in equity.

But they are struggling with how to tap into that equity.

A home equity line of credit (HELOC) is fast, convenient, and comes with low closing costs. Most importantly, you don’t have to touch your first mortgage to get one.

A cash-out refinance, though, replaces your first mortgage and gives you cash back for the new loan amount that exceeds your old one. That gives you a potentially higher rate, plus additional closing costs.

But a cash-out refi limits your exposure to a Federal Reserve that is determined to raise rates. Home equity rates are adjustable and rise every time the Fed hikes rates. A 30-year fixed cash-out loan payment never changes.

Consider a scenario where a homeowner needs $50,000 cash. Shortly after taking the HELOC, the Fed hikes rates to 2007 levels.

| Cash-out Refi | HELOC at 9% | HELOC – 10 Yr Payoff | |

| First Mortgage | $273,000 | $220,000 | $220,000 |

| HELOC | N/A | $50,500 | $50,500 |

| 1st Mortgage Payment | $1,420 (@4.75%) | $1,200 (@3.75%) | $1,200 (@3.75%) |

| HELOC Payment | N/A | $380 (@9% interest only payment) | $680 (@9%, fully amortized 10-yr period) |

| Total Mortgage Payment | $1,420 | $1,580 | $1,880 |

To make matters worse, HELOCs eventually turn into “fully amortizing” loans. When they begin, they often require that only interest is paid.

The principal-plus-interest payment at 9% gets pretty steep.

But with a cash-out loan, you avoid that risk. You lock in at a certain rate and stay there as long as you keep the loan.

So, a HELOC may not be the best home equity tool, after all.

Get a cash-out rate quote here. (Oct 3rd, 2018)

Loan product rate updates

Many mortgage shoppers don’t realize there are many different types of mortgage rates. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are updates for specific loan types and their corresponding rates.

Conventional loan rates

Conventional refinance rates and those for home purchases are still low despite recent increases.

According to loan software company Ellie Mae, the 30-year mortgage rate averaged 4.94% in August, the most recent data available.

This is slightly higher than Freddie Mac’s 4.72% average because it factors in low credit and low-down-payment conventional loan closings, which tend to come with higher rates.

Lower credit score borrowers can use conventional loans, but these loans are more suited for those with decent credit and at least 3% down. Five percent down is preferable due to higher rates that come with lower down payments.

Twenty percent of equity is preferred when refinancing.

With adequate equity in the home, a conventional refinance can pay off any loan type. Got an Alt-A, subprime, or high-PMI loan? A conventional refi can take care of it.

For instance, say you purchased a home three years ago with an FHA loan at 3.5% down. Since then, home values have skyrocketed.

You refinance into a conventional loan (because you now have 20% equity) and eliminate FHA mortgage insurance.

This could be a savings of hundreds of dollars per month, even if your interest rate goes up.

Getting rid of mortgage insurance is a big deal. This mortgage calculator with PMI estimates your current mortgage insurance cost. Enter 20% down to see your new payment without PMI.

Verify your conventional loan eligibility (Oct 3rd, 2018)

FHA mortgage rates

FHA is currently the go-to program for home buyers who may not qualify for conventional loans.

The good news is that you will get a similar rate — or even lower one — with an FHA loan than you will with conventional.

FHA loan calculator:

Related: Read more about FHA costs and requirements on our FHA loan calculator page.

According to loan software company Ellie Mae, which processes more than 3 million loans per year, FHA loan rates averaged 4.95% in August, while conventional loans averaged 4.94%.

Another interesting stat from Ellie Mae: About 30% of all FHA loans are issued to applicants with scores below 650.

FHA loans come with mortgage insurance. But overall cost is not much more than for conventional loans.

A little-known program, called the FHA streamline refinance, lets you convert your current FHA loan into a new one at a lower rate if rates are now lower.

An FHA streamline requires no W2s, pay stubs, or tax returns. And you don’t need an appraisal, so home value doesn’t matter.

VA mortgage rates

Homeowners with a VA loan currently are eligible for the ever-popular VA streamline refinance.

No income, asset, or appraisal documentation is required.

If you’ve experienced a loss of income or diminished savings, a VA streamline can get you into a lower rate and better financial situation. This is true even when you wouldn’t qualify for a standard refinance.

But don’t overlook the VA loan for home buying. It requires zero down payment. That means if you have the cash for closing costs, or can get them paid for by the seller, you can buy a home without raising any additional funds.

“Don’t overlook the VA loan for home buying. It requires zero down payment.”

VA mortgages are offered by local and national lenders, not by the government directly.

This public-private partnership gives consumers the best of both worlds: strong government backing and the convenience and speed of a private company.

Most lenders will accept scores down to 620, or even lower. Plus, you don’t pay high interest rates for low scores.

Quite the contrary, VA loans come with the lowest rates of all loan types according to Ellie Mae. In August, 30-year VA mortgage rates averaged just 4.74% while conventional loans averaged 4.94%

Check your monthly payment with this VA loan calculator.

There’s incredible value in VA loans.

USDA mortgage rates

Like FHA and VA, current USDA loan holders can refinance via a “streamlined” process.

With the USDA streamline refinance, you don’t need a new appraisal. You don’t even have to qualify using your current income. The lender will only make sure that you are still within USDA income limits.

More about the USDA streamline refinance.

Home buyers are also learning the benefits of the USDA loan program for home buying.

No down payment is required, and rates are ultra-low.

Home payments can be even lower than rent payments, as this USDA loan calculator shows.

Qualification is easier because the government wants to spur homeownership in rural areas. Home buyers might qualify even if they’ve been turned down for another loan type in the past.

Mortgage rates today

While a monthly mortgage rate forecast is helpful, it’s important to know that rates change daily.

You might get 4.7% today, and 4.8% tomorrow. Many factors alter the direction of current mortgage rates.

This month’s economic calendar

The next thirty days hold no shortage of market-moving news. In general, news that points to a strengthening economy could mean higher rates, while bad news can make rates drop.

- Tuesday, October 2: Fed Chair Jerome Powell speaks

- Friday, October 5: Nonfarm Payrolls, wages, unemployment rate

- Thursday, October 11: Consumer Price Index (a key inflation gauge)

- Monday, October 15: Retail Sales

- Wednesday, October 17: Housing Starts

- Wednesday, October 17: FOMC Minutes

- Friday, October 19: Existing-Home Sales

- Wednesday, October 24: New Home Sales

- Friday, October 26: GDP

Now could be the time to lock in a rate in case these events push up rates this month.

What are today’s mortgage rates?

Despite recent upticks, low mortgage rates are still available. You can get a rate quote within minutes over the phone or online, with just a few simple steps to start.

Show Me Today's Rates (Oct 3rd, 2018)

Selected sources:

- https://www.usatoday.com/story/money/2018/06/11/recession-2020-heres-why-economists-think-may-happen/686177002/

- http://www.freddiemac.com/pmms/

- https://www.statista.com/statistics/375865/value-of-homeowner-equity-usa/